During my time at Ribbon Home, I was part of a dedicated product team tasked with building a home closing experience for the Ribbon web app.

What are the problems homebuyers and real estate agents are facing?

Closing on a home can be a long, grueling process. For many first time homebuyers and real estate agents, the process of closing on a home can include:

delays and uncertainty

endless amounts of paperwork

a sea of emails, text messages and documents which can make it easy to lose track of where things are

several “actors” involved

a lengthy negotiation process

home inspections, resulting in necessary and costly repairs

waiting for loan officers to help secure financing

What are the problems Ribbon is facing?

With all these existing frustrations, buyers seemed overwhelmed when Ribbon was added to the transaction. Below are the problems faced on Ribbon’s end:

The Ribbon app was not fully built out to support the closing experience

once an offer on a home was accepted, every remaining part of the Ribbon deal took place offline and manually, which made it confusing for homebuyers, agents and our internal transaction coordinators

the temporary solution of including a “pizza tracker” in the offer creation experience was not flexible enough to help guide agents and buyers through a non-linear closing process

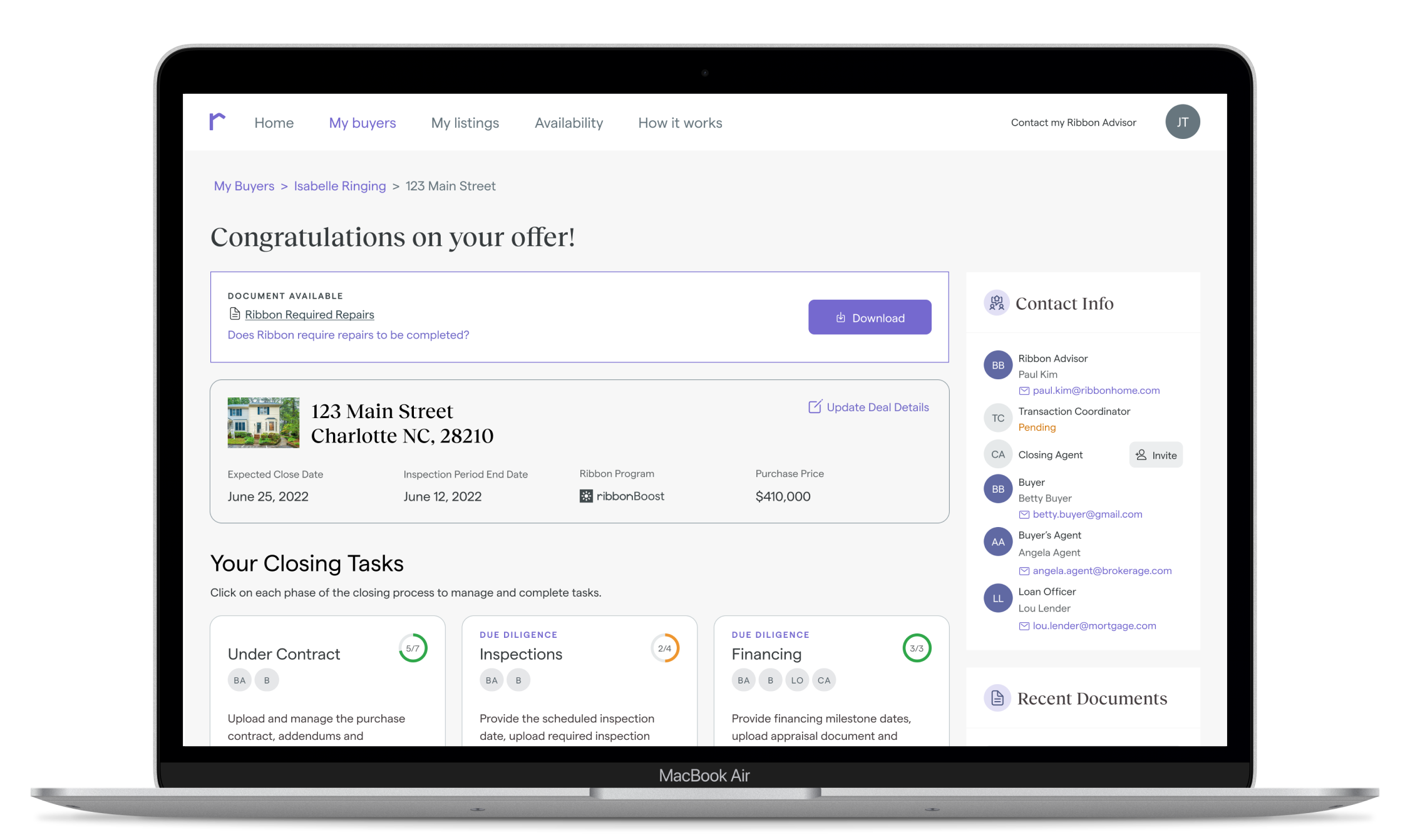

Ribbon buyer property page; design does not account for the closing experience

Objectives

Our objective as a team was to:

Deliver an organized visual representation of the closing process

Reduce deal termination rate (25% inspections, 22% buyer related)

Improve NPS, reduce detractor score comments due to “handoffs” and unclear expectations

Empower end users to self serve and automate existing workflows

Minimize closing delays (avg 8.3 days, 9% lender delay, 5% internal delay, 76% unreported)

Improve efficiency of the internal Ribbon team to handle more closings

Evolve to handle workflows more intelligently

Allow changes to deal types in the UI and back-end

Trigger notifications based on dates and specific context

Discovery

I had no relevant data nor knowledge around the closing process to even begin ideating. My best bet was to talk directly with agents and Ribbon transaction coordinators to determine what the biggest points of friction were and to get a better sense of the steps involved. I interviewed several real estate agents including some who had worked with Ribbon before.

As an outcome, we were able to create user task flows and journey maps in order to identify gaps and begin proposing solutions.

Initial Task Flow for Ribbon Transaction Coordinators and Inspections Team (FigJam Link)

Agents and Homebuyers Closing Process

Transaction Coordinators Task Flow

Loan Officer Workflow

Design Considerations

For the design solutions, we needed to think about:

how to to present the different phases of closing, while allowing the end user to access each phase of closing at any given time

how to build transparency and tracking around tasks

how to include contextual information and surface them in a timely manner

how to get the agent from the offers creation experience into the closing experience seamlessly with an improved UI that still felt consistent with the rest of the Ribbon experience

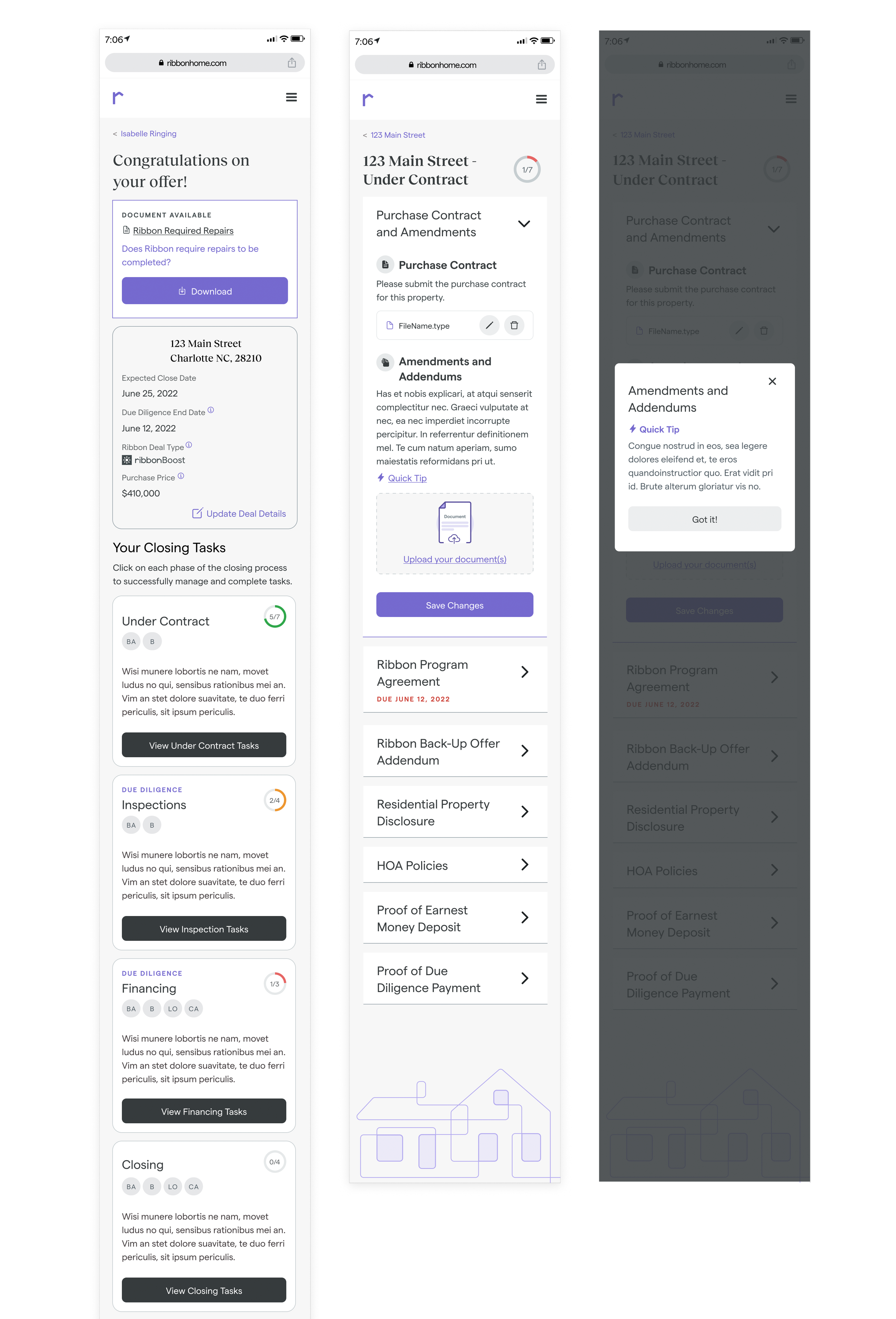

building a solution that was scalable, flexible and mobile-friendly

Design Solutions

After testing a first round of designs, we learned a lot about the agent and lender workflow. Overall, agents and lenders found that the layout was intuitive and aligned with their responsibilities and workflows. They found value in a closing experience that showed them all the tasks and process overview in one place.

Closing Homepage

Under Contract Task Page

Financing Task Page for Loan Officers

Appraisal Rebuttal / Contextual Information within Task Pages

Mobile Designs for the Ribbon Closing Experience

Early Learnings

Points of Improvement

As we launched the experience, we noticed that most of the friction occurred during the offers to closing experience, where agents were asked to submit executed documents:

Error message could have been less harsh; we want agents to know that they could skip this step if they needed and so we changed the colors of the error message from red to orange as a warning

The ML algorithm to read and split documents was overly aggressive at times, splitting what should be one document into several other document types

Achievements

With this new closing experience, we were able to:

reduce the number of deals with closing delays by 18%, leading to a better customer experience

reduce the average time to close by 2 days, enabling the company to collect fees earlier

streamline the real estate closing experience with a 22% improvement in operational efficiency

A more detailed case study for this project is available upon request.